Using the Direct Procurement for Customers Model in the Water Sector: Four Lessons Learned

Our Sector Lead for Contracts and Procurement Advisory David Sandercock shares four lessons for implementation success

Financing and procurement are two of the most critical challenges within major projects globally. They’re two factors that play an integral role in defining the success of the projects — especially long-term cost and risk. Funding and delivery models can help create the right cost structures and improve procurement results through competitive tenders or bids.

The U.K. has an ambitious program with a proposed $114 billion (£96 billion) budget for water utilities to develop resilient, sustainable major water infrastructure projects between 2025 and 2030 - this is in addition to major standalone schemes. The industry requires effective procurement and delivery mechanisms, and the Direct Procurement for Customers (DPC) model offers a tailored solution and multiple client benefits, especially within the fast-growing water sector. DPC brings together the water regulator, water companies, delivery partners and third-party investors to deliver major projects in England and Wales’ water sector.

Our Sector Lead for Contracts and Procurement Advisory David Sandercock shares four lessons for implementation success.

DPC is a similar delivery model to the Design Build Finance Operate (DBFO) and Design Build Finance Operate Maintain (DBFOM) contracts under the wider Public Private Partnerships (P3) umbrella. DPC allows water companies in the U.K. to competitively tender for a third party to design, build, finance, operate and maintain assets in their service supply area.

The U.K. water regulator Ofwat has mandated this as the standard for all major projects estimated at $252 million (£200 million) in total expenditure (Capex and Opex). Due to its competitive nature and a whole-life cost approach, the model can deliver significant benefits for end customers through innovative solutions and substantial cost savings achieved by balancing initial capital, upfront financing, renewals capital and operational costs. Essentially, the DPC helps find the right solution providers for the project at the right price.

Understanding the DPC model

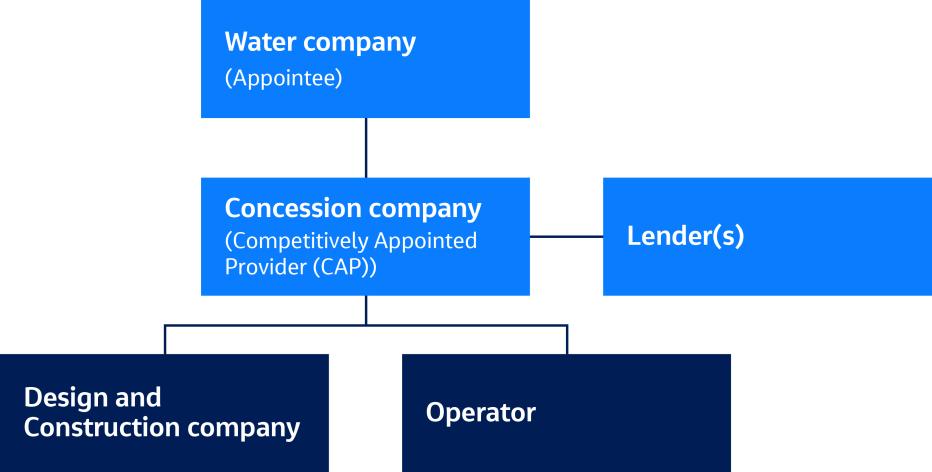

The model encourages organizations to be established to finance, design, build, operate and maintain assets, or simply to design, build and finance these assets. The contracts involve a Special Purpose Vehicle (a third-party concession company), termed under the DPC model a Competitively Appointed Provider (CAP), which is a company specially set up to deliver that project (see Figure 1). Depending on the scale, it’s common to find that the CAP is a standalone company formed from a joint venture (JV) or consortia of companies. The CAP will normally appoint a design and construction organization, potentially a JV depending on the scale, which often comprises a group of companies related to those within the CAP itself. The CAP also usually appoints an operator, although this is occasionally done by the CAP establishing an in-house department.

In terms of finance, lenders typically fund the project with a mixture of equity and loan debt. Often, the contractors’ related companies within the CAP will have access to their own pension funds, and most parties involved generally have some stake in the outcome.

Water companies will ultimately fund regular payments to the CAP through customers’ bills. All stakeholders, including investors, alongside the CAP, will want confidence that they will receive regular payments at the time they bid.

Figure 1- Basic set-up of a DPC delivery model

Making the most of DPC to deliver major water infrastructure

Considering there has been limited new major infrastructure in the U.K. water sector over recent decades, the level of proven, industry-wide insights is constrained. However, there are several cross-sector lessons to be implemented and track record experience that can be used for guidance. There are also a few specificities to the DPC model to keep in mind. Here are four insights into the DPC model.

- Deploying a programmatic approach will help tackle complexity and scale.

DPCs are major projects and need to be managed as such. To understand how a major project is set up, you need to develop a plan to understand the integration and collaboration required and to iterate and adapt as the project changes. Strategic requirements can change as the project evolves, so having the governance to understand and control this is critically important. Part of this success also relies on transparency and great communication. You need to ensure that all strategic requirement changes are rippled throughout the entire project organization — everyone needs to come on that journey with you.

- Using cross-sectoral experience is vital.

As there are limited examples of major new infrastructure being built in the last 30 years in the U.K. water sector, it’s imperative to lean on other sector experience, such as transportation. DPC might be a relatively new terminology, however it has been widely used in different sectors under the guise of DBFO.

For example, Jacobs worked with National Highways to develop DBFO contracts. We’ve recently helped deliver the A465 Project in Wales and are working on the A9 Project in Scotland. Farther afield, we are working on the U.S. Fargo-Moorhead Flood Diversion Project to advise on a P3 flood protection scheme, where we’ve facilitated the first-ever P3 program for the U.S. Army Corps of Engineers. We have worked client-side and in a DBFO bidder role, including as the technical partner on one of the three U.K. DPC pathfinder projects, the award-winning Haweswater Aqueduct Resilience Programme.

Having experienced partners familiar with all stages of a DPC project can add incredible value in lessons learned and the integration of multi-disciplinary skills. Delivering a DPC contract can be complex and requires a deep understanding of the technical, regulatory and financial environment to drive effective collaboration and inform the best strategy and delivery approach for all stakeholders. This range of expertise can include relevant technical domain skills such as environmental planning or consenting, major projects capabilities, strategic or technical advice, independent engineering capabilities and technical advice to lenders.

- Scope definition, risk awareness and reference designs are critical for success.

DPC contracts differ from existing industry contracts such as the New Engineering Contract. DPC projects will typically transfer more risk. The proposed risk allocation must be clearly understood and articulated during contract drafting. For example, the CAP manages the design approval risk on a DPC contract, not the ultimate client, the water company.

To make major projects thrive, risks need to be managed appropriately, and data needs to be provided to bidders so that they can understand and make appropriate allowances for the risks they are to manage. For example, assessing construction risk through ground investigations and surveys is vital. However, it’s also essential to do this proportionately to requirements.

A good reference design is vital, as it informs costing, carbon management, scheduling and innovation strategies for bidders.

Having this information built robustly is crucial as DPC bidders — the parties that will ultimately carry this risk — must be given a fair opportunity to understand, cost and mitigate these risks. Bidding for a DPC contract is a significant investment, usually in the order of millions, so accuracy and reliability are paramount.

- The whole-life approach of DPC contracts offers benefits.

DBFOs have helped massively in making stakeholders understand the whole life cost of an infrastructure asset, from building to operating and maintaining it. The contract creates tension between capital expenditure (CapEx) investment versus operational expenditure (OpEx) and renewals or lifecycle CapEx. It has meant that this relationship is now far better understood as an industry. A DPC contract enables future infrastructure maintenance requirements to be built into the CAP’s financial model and considered upfront in the decision-making of the initial CapEx, providing transparency and enabling robust maintenance planning.

DPCs present an opportunity to build long-term resilience of our water resources through an alternative delivery of major infrastructure using private finance. The competitive tendering model encourages innovation by the supply chain and provides savings in total capital and operational and renewal costs. Effective and informed risk transfer and a whole-life cost approach are key benefits of DPC, which enable the clear planning of investment needed, giving stakeholders confidence in project deliverability and return on investment.

About the author

David Sandercock leads Jacobs’ U.K. Contracts and Procurement Advisory team. With over 30 years of experience in the industry, David brings a deep understanding of major infrastructure delivery across multiple sectors. This includes various contracting and procurement models, from traditional frameworks such as the Institution of Civil Engineers and the International Federation of Consulting Engineers to New Engineering Contracts and the various forms of P3 and Private Finance Initiatives.

Future Foundations.

Co-creating the world to come

From developing climate resilience and transitioning to a low-carbon future, to modernizing and transforming infrastructure, governments and businesses face critical challenges. How they respond will define our future.

As our clients navigate these challenges, we help them think differently – working together to pioneer tomorrow's infrastructure solutions and build the foundations for a prosperous, secure future.